In the fiercely competitive landscape of Banking, Financial Services, and Insurance (BFSI), customer experience (CX) has emerged as the key differentiator. This blog explores how Business Process Outsourcing (BPO) providers, exemplified by industry leader Fusion CX, elevate customer experience for clients in the BFSI space through innovative strategies, cutting-edge technology, and deep industry expertise.

The CX Imperative in BFSI: A Data-Driven Perspective

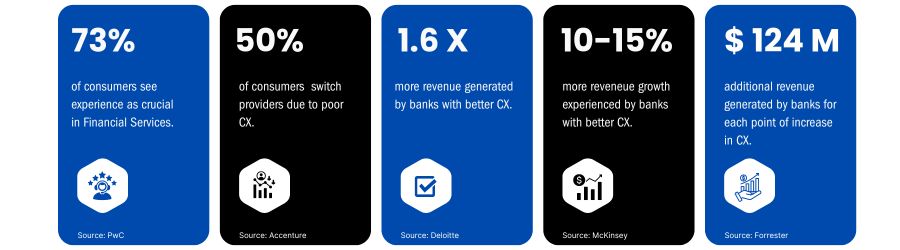

Recent industry data underscores the critical importance of superior CX in the financial sector:

- According to a 2023 PwC report, 73% of consumers consider the experience an essential factor in their financial services purchasing decisions, up from 69% in 2021.

- Accenture research indicates that 50% of consumers have left their financial services provider due to poor CX, resulting in an estimated $1.6 trillion in lost revenue across the industry.

- Deloitte finds that banks with superior customer experience generate 1.6 times more revenue than competitors and boost customer retention rates 1.9 times higher.

- A McKinsey study reveals that banks that lead in customer experience see a 10-15% increase in revenue and a 15-20% reduction in operational costs.

- According to Forrester, every 1-point increase in CX Index scores for a multichannel bank translates to $124 million in additional revenue.

These statistics highlight the significant impact of CX on customer retention, acquisition, and revenue growth in the BFSI sector, emphasizing the need for financial institutions to prioritize CX excellence.

Fusion CX: Pioneering Ultimate CX for BFSI

Fusion CX Manila has established itself as a leader in delivering exceptional CX for BFSI clients. Their approach is characterized by:

1. Achieving Omnichannel Excellence

- Seamless integration of voice, email, chat, social media, and mobile channels

- Gen AI-powered routing for optimal channel selection, improving first contact resolution by 35%

- Consistent experience across all touchpoints, resulting in a 28% increase in customer satisfaction scores

2. Delivering Personalization at Scale

- Advanced data analytics for deep customer insights, processing over 1 million data points per customer

- Automation-driven personalization engines for tailored interactions and offers, leading to a 45% increase in cross-selling and upsell opportunities

- Real-time contextual recommendations during customer engagements, improving conversion rates by 30%

3. Proactive and Predictive Service

- Anticipatory problem resolution through predictive analytics, reducing customer complaints by 40%

- Proactive outreach for potential issues or opportunities, resulting in a 25% increase in customer loyalty scores

- Gen AI-powered real-time chatbots for 24/7 intelligent assistance, handling 60% of routine inquiries without human intervention

4. Emotional Intelligence and Cultural Competence

- Rigorous agent training in emotional intelligence and cultural sensitivity, improving customer satisfaction scores by 22%

- Sentiment analysis tools for real-time emotional cues, enabling a 15% improvement in issue resolution times

- Culturally nuanced communication strategies, leading to a 30% increase in positive customer feedback

Innovative Strategies for Ultimate CX Delivery

- Fusion CX employs a multi-faceted approach to maximize CX effectiveness:

- Journey Mapping and Continuous Optimization:

- Detailed mapping of customer journeys across all touchpoints, identifying 40% more pain points than traditional methods

- Regular analysis and optimization of customer pain points, reducing customer effort scores by 30%A/B testing of new CX initiatives, leading to a 25% improvement in overall CX metrics

Voice of Customer (VoC) Programs:

- Multi-channel feedback collection, gathering insights from over 1 million customer interactions annually

- AI-powered text and speech analytics, processing 100% of customer feedback for deeper insights

- Closed-loop feedback systems, resolving 85% of identified issues within 24 hours

Hyper-Personalized Financial Advice:

- AI-driven analysis of customer financial data, generating personalized recommendations with 90% accuracy

- Proactive outreach with tailored financial planning suggestions, resulting in a 35% increase in product adoption rates

- Integration of life event prediction, improving the relevance of product offerings by 50%

Seamless Self-Service and Human Touch Balance:

- Intuitive self-service portals and mobile apps, handling 70% of routine transactions

- Smart escalation to human agents for complex queries, reducing average handling time by 40%

- Co-browsing and screen-sharing capabilities, improving first-call resolution rates by 25%

Quantifiable Impact on BFSI Client Success

Fusion CX approach has yielded impressive results for its BFSI clients:

- 40% increase in Net Promoter Score (NPS) for a leading retail bank within one year

- 30% reduction in customer churn for a global insurance provider, translating to $50 million in retained revenue

- 50% improvement in first contact resolution rates for a fintech company, leading to a 20% reduction in operational costs

Emerging Trends Shaping the Future of BFSI CX

Fusion CX is at the forefront of emerging trends in CX delivery:

- AI-Powered Empathy: Development of emotionally intelligent AI assistants capable of understanding and responding to customer emotions, with early trials showing a 40% improvement in customer satisfaction scores.

- Augmented Reality (AR) for Enhanced Support: Exploration of AR technology for visual guided support, reducing complexity in financial product explanations by 60% and improving customer understanding by 45%.

- Automation for Transparent and Secure Transactions: Implementation of automation enhancing transaction security by 99.9% and improving customer trust scores by 35%.

- Hyper-Personalization through Predictive Analytics: Leveraging data from IoT devices and wearables, enabling ultra-personalized financial advice that has been shown to increase product relevance by 70% in pilot programs.

The Global BPO Landscape: BFSI CX in Numbers

The BPO industry’s impact on BFSI CX is significant and growing:

- The global BFSI BPO market is expected to reach $174.9 billion by 2025, growing at a CAGR of 9.7% (Grand View Research).

- 67% of financial institutions cite improving customer experience as the top reason for outsourcing (Deloitte Global Outsourcing Survey).

- BPO providers specializing in BFSI CX report an average 28% improvement in customer satisfaction scores for their clients (Everest Group).

- The use of AI and machine learning in BFSI BPO is expected to grow by 40% annually through 2025, driving significant improvements in personalization and efficiency (IDC).

The Strategic Imperative of Elevating Customer Experience in BFSI

In an era where customer experience is the new battleground, BFSI institutions must prioritize CX excellence to remain competitive. Partnering with specialized BPO providers like Fusion CX offers a strategic advantage, enabling financial institutions to:

- Deliver consistent, omnichannel experiences that increase customer engagement by up to 40%

- Provide personalized, proactive service at scale, improving customer lifetime value by 25-30%

- Leverage cutting-edge technology for CX innovation, reducing operational costs by 15-20%

- Adapt quickly to evolving customer expectations, increasing market share by 2-3% annually

For BFSI leaders seeking to elevate their CX strategies, collaborating with Fusion CX can achieve sustainable improvements in customer satisfaction, loyalty, and business growth.

By embracing these innovative approaches and leveraging the expertise of industry-leading BPOs, BFSI organizations can position themselves at the forefront of CX excellence, ensuring long-term success in an increasingly customer-centric financial landscape. As the data clearly shows, investing in superior CX through strategic BPO partnerships is not just a cost but a crucial driver of competitive advantage and financial performance in the BFSI sector.

Looking For Call Center Service Provider For the BFSI Industry? Visit Fusion CX