Successful relationships are based on trust with friends, family, colleagues, or the brands we engage with. This trust is crucial in the banking and financial services sector. Customers must have faith in the institutions they entrust with their finances. Therefore, building and maintaining trust is of paramount importance. In this article, we look at the role of Millennials in Financial Services.

Millennials: The Key Customer Segment for Financial Services

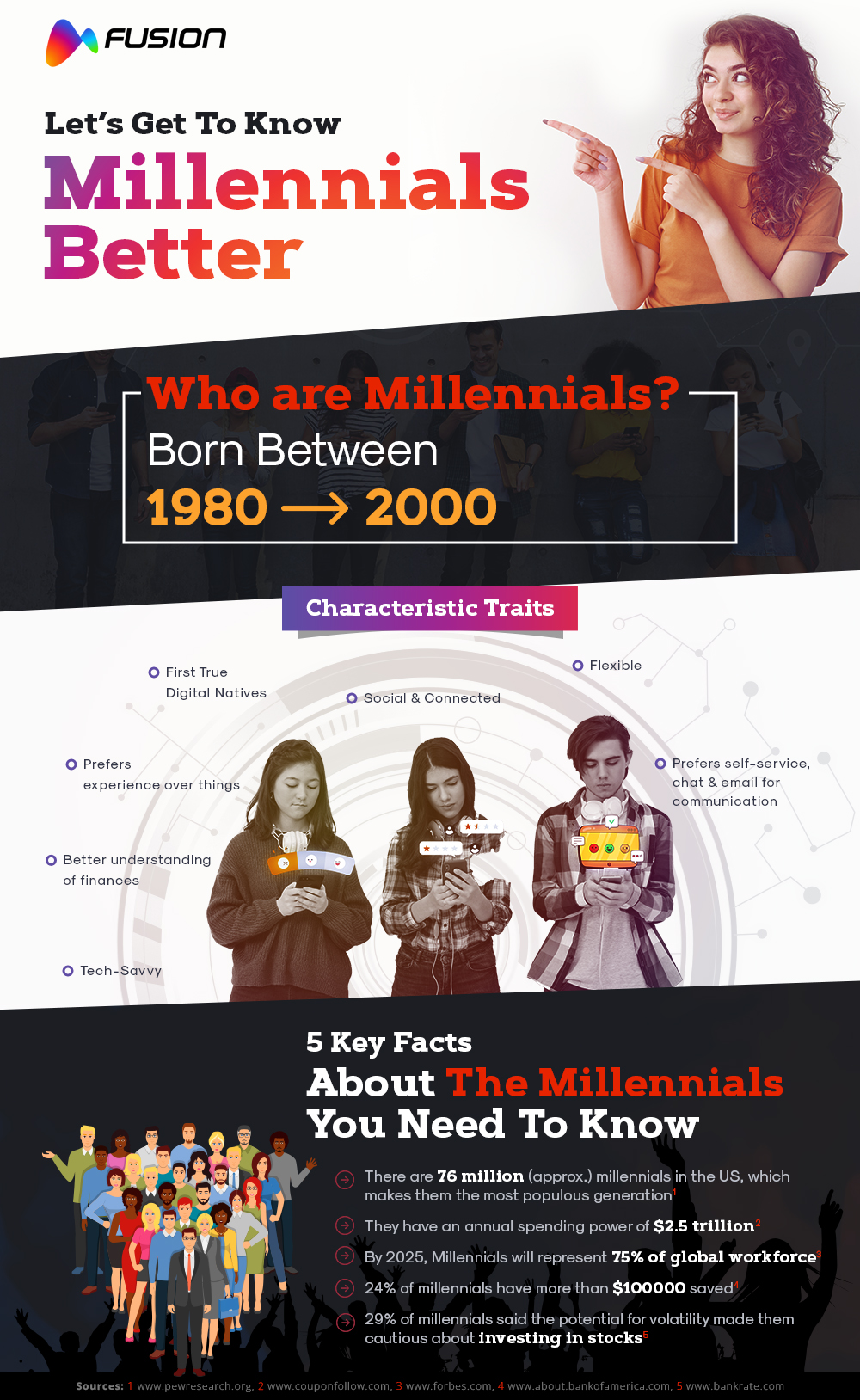

Millennials, born between 1980 and 2000, are a significant and growing segment in the financial services sector. They represent a valuable customer base with their increasing purchasing power and willingness to take investment risks. However, many financial brands struggle to gain trust due to a lack of seamless banking experiences.

As digital natives, millennials are accustomed to purchasing smartphones and prefer self-service options, such as interacting with voice and chatbots. They value experiences over material things, making it essential for financial institutions to personalize customer interactions. To win their trust, anticipate their needs, identify pain points, and offer tailor-made solutions.

Enhancing Customer Experience to Build Trust

Customer behavior and expectations are evolving. Financial services brands must focus on delivering consistent, transparent, and unified communication across multiple channels. This requires a robust customer experience (CX) strategy, which includes 24/7 support, zero downtime, and consistent customer engagement.

Partnering with a financial services BPO can help ensure a glitch-free experience, boosting customer engagement and brand loyalty. An effective CX strategy involves connecting

with customers across multiple channels and providing personalized, surprise interaction elements.

The Role of Omnichannel Customer Experience in Engaging Millennials in Financial Services

The financial services landscape is shifting towards an omnichannel approach, allowing customers to interact seamlessly through their preferred platforms (mobile app, chat, voice, or email). This approach places the customer at the center of the transaction rather than the institution.

An omnichannel strategy enables customer service agents to access complete customer information from a single platform, improving understanding and service personalization. This approach helps break down information silos, enhances interdepartmental transparency, and makes customer interactions faster and more effective. Ultimately, an omnichannel approach fosters customer trust through streamlined operations and a superior customer experience.

Conclusion

For businesses, particularly in the BFSI sector, the trust of the millennial customer base is a vital asset. With millennials forming a large portion of the present and future customer base, financial institutions must connect with them personally through omnichannel customer experiences. The right banking BPO partner can facilitate superior customer engagement and experience, fostering trust and brand loyalty. Now, that’s an investment worth making.

Ready to transform your customer experience strategy and build lasting trust with millennial customers? Partner with Fusion CX today and leverage our expertise in delivering seamless omnichannel customer experiences. Contact us now to learn more and get started!